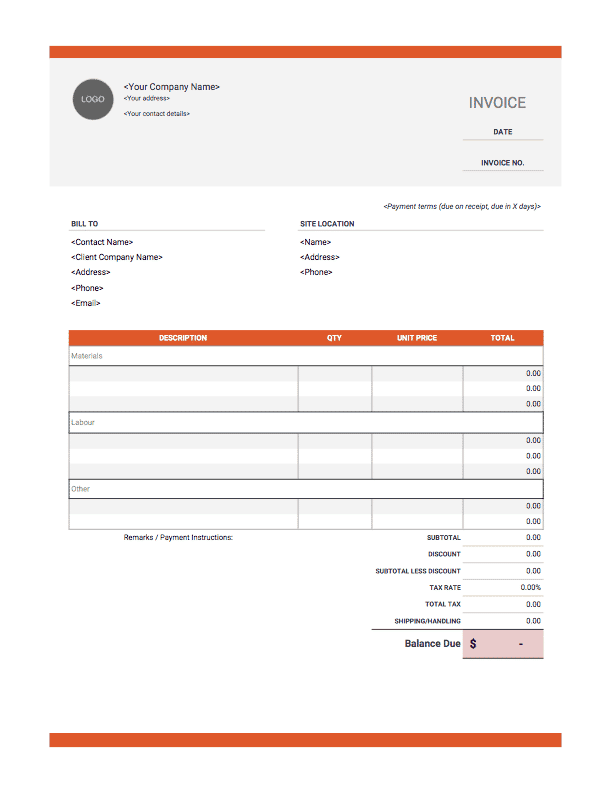

All you need to do is say when your babysitter worked and have your new babysitter sign up to get paid and give their tax info. For a small monthly fee, HomePay takes care of setting up direct deposit for your babysitter, withholding taxes, and preparing the needed tax forms. Contractor will guarantee and pay the reservation/expense through the normal invoice process, but needs assistance to finalize reservations because access. If you’re hiring a babysitter as a household employee and don’t want to deal with all that, you can use a service like HomePay to avoid being a household employer. It must be completely obvious, maybe use a large bold font. Company will reimburse Contractor for any reasonable and pre-approved, out-of-pocket expenses incurred by Contractor in performing the Services (the Expenses). Make sure the actual word ‘invoice’ is clearly at the top of your document.

#INDEPENDENT CONTRACTOR EXPENSES WHEN RECEIPT NEEDED PROFESSIONAL#

Record, report and submit expense reports efficiently and on time. Be certain that you’re sending a professional invoice to your clients by including these details. This does not apply to your spouse, your child who is under 21, or your parent. Easily manage financial documents and other records using a business receipt tracker. All travel related expenses for honoraria (lump sum only), will require.

File Schedule H with your Form 1040 when you file your tax return.Required for reimbursement of actual expenses and 1099 or. The person hiring a babysitter must pay the household employment tax or nanny tax ( see IRS Publication 926). Payments to independent contractors and guest speakers for services will be subject.

0 kommentar(er)

0 kommentar(er)